Health Insurance for Nomads – Safety Wing Review

These days travel insurance for short trips isn’t an issue, as even many credit cards offer some form of coverage. But, if you’re traveling for extended periods as a digital nomad or worldschooling family it’s a totally different story as you need more than just a basic theft and emergency coverage. Especially when traveling with kids, you might need more extensive care and your insurance from home will most likely not cover your expenses abroad.

This is where Nomad Insurance Essential and Nomad Insurance Complete from Safety Wing come in handy, as they’re specifically designed for nomads. The insurance offers both travel and extended longer-term coverage.

How’s Safety Wing Nomad Insurance Different?

Safety Wing Nomad Insurance was created for expats and digital nomads, who stay outside of their country most of the year. It covers more than a standard accidental travel insurance.

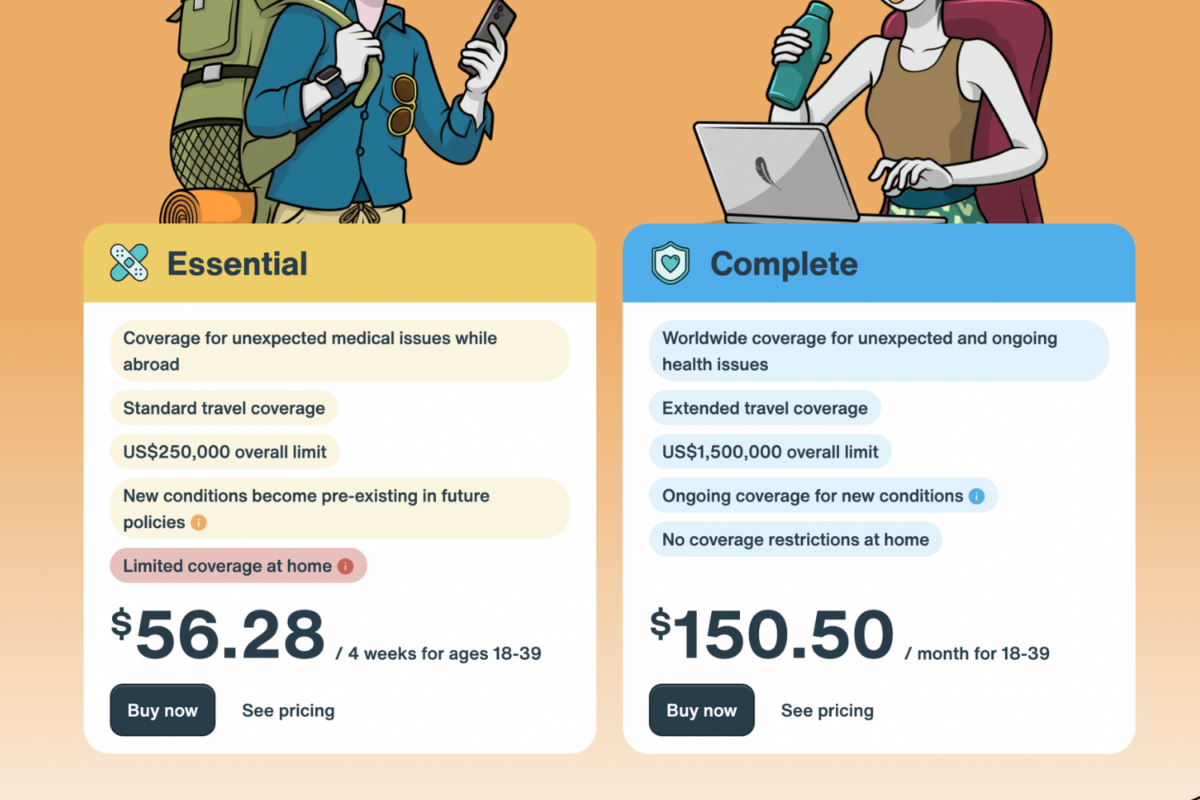

You can pick between Essential and Complete plans. The first one is best for frequent but shorter stays, while the complete one is better suited for perpetual nomads.

I have been using Essential, which is ideal for short and mid-term trips. The other option is Complete, perfect for long-term trips such as a sabbatical or for digital nomads who are always on the road.

The Complete plan is similar to what you would have at home and you can even add adventure sports or US coverage, which is very rare for travel insurance.

Who’s Nomad Insurance For and Who Is It Not?

I often see a lot of complaints about every insurance available on the market. According to internet users, every insurance is bad… while in reality not many bother to read the actual policy and know what’s covered and what’s not.

A typical standard travel insurance will cover you for emergencies, but you can’t just visit a specialist while abroad as it’s not an emergency. This is how Nomad Insurance differs, as it does cover these routine checkups abroad.

The most important fact is that under the Complete plan, you are covered up to USD 1,500,000 a year, which is plenty. You do need to call them and inform them about going to the hospital or for treatment – it’s not a unique matter, almost all travel insurance has this rule, but worth mentioning as many people don’t know about it.

Anyone can buy a Safety Wing Nomad Insurance Essential if:

- they’re between 2 weeks and 70 years old.

- their home country is NOT sanctioned (North Korea, Syria, Cuba, and Iran).

- you as an individual are sanctioned under any of the sanctioned regimes (double citizenship for example).

- your destinations cannot be: Belarus, Cuba, Iran, North Korea, Russia, Syria, Ukraine, and your home country (where you principally reside and receive mail).

Anyone can buy a Safety Wing Nomad Insurance Complete if:

- they’re between 2 weeks and 74 years old.

- their home country is NOT sanctioned (North Korea, Syria, Cuba, and Iran).

- you as an individual are sanctioned under any of the sanctioned regimes (double citizenship for example).

- your residence (living 6+ months in a year) cannot be: Belarus, Canada, DRC, Ireland, Palau, Saudi Arabia, UAE, USA

However, under the Complete plan you are covered in your country of residence while visiting and anywhere you travel, except any country or area that is sanctioned.

Pre-Existing Conditions Coverage

You also need to take into consideration the coverage of pre-exisiting conditions, if you have any. Having a pre-exisiting condition doesn’t mean that you can’t or shouldn’t buy travel insurance. It just means that this specific condition won’t be covered. For example, since I have psoriasis I know that neither my specialty medicine nor any treatment will be covered by Nomad Insurance, but it doesn’t mean that I cannot be covered for other things.

While Nomad Insurance does not cover pre-existing conditions there are exceptions in the Complete plan:

- Maternity Care is covered after 10 month wait period

- Cancer screening and treatment are covered (this is huge!)

- New conditions, such as diabetes, can be covered as long as you haven’t had them. before

- Dental treatments

Can You Add Children to Safety Wing Nomad Insurance?

Sure you can. Under the Essential plan kids under 10 years old are free with a covered adult and so is the add-on for theft, US coverage, and adventure sports. You will still have to pay $100 co-pay for each visit to an emergency room in the US and $50 co-pay for each visit to an urgent care center in the US.

In the Complete plan kids under 10 years old will cost you $99 with an adventure sports add-on and no co-pays in the US.

Is Safety Wing Insurance Worth It?

When I started traveling there weren’t many options for travel insurance and pretty much none for extended care abroad. Safety Wing offers competitive prices for what they’re offering so in my opinion, yes, it’s worth it.

Whether your flight is delayed, your bag is lost, or you need to cancel a trip due to unforeseen circumstances having travel insurance is essential.

Is Safety Wing Insurance Enough To Cover You?

If you’re a reasonably healthy individual without pre-existing conditions, then Nomad Insurance is great. It will take care of your routine and incidental care and cover acute and sudden issues.

Depending on your travel plans and lifestyle you still might have to purchase or pay for additional add-ons. For example, we’re leaving for France soon and plan on sending the kids to a French school we need to buy separate school insurance for the kids as it’s something separate from any travel or health insurance.